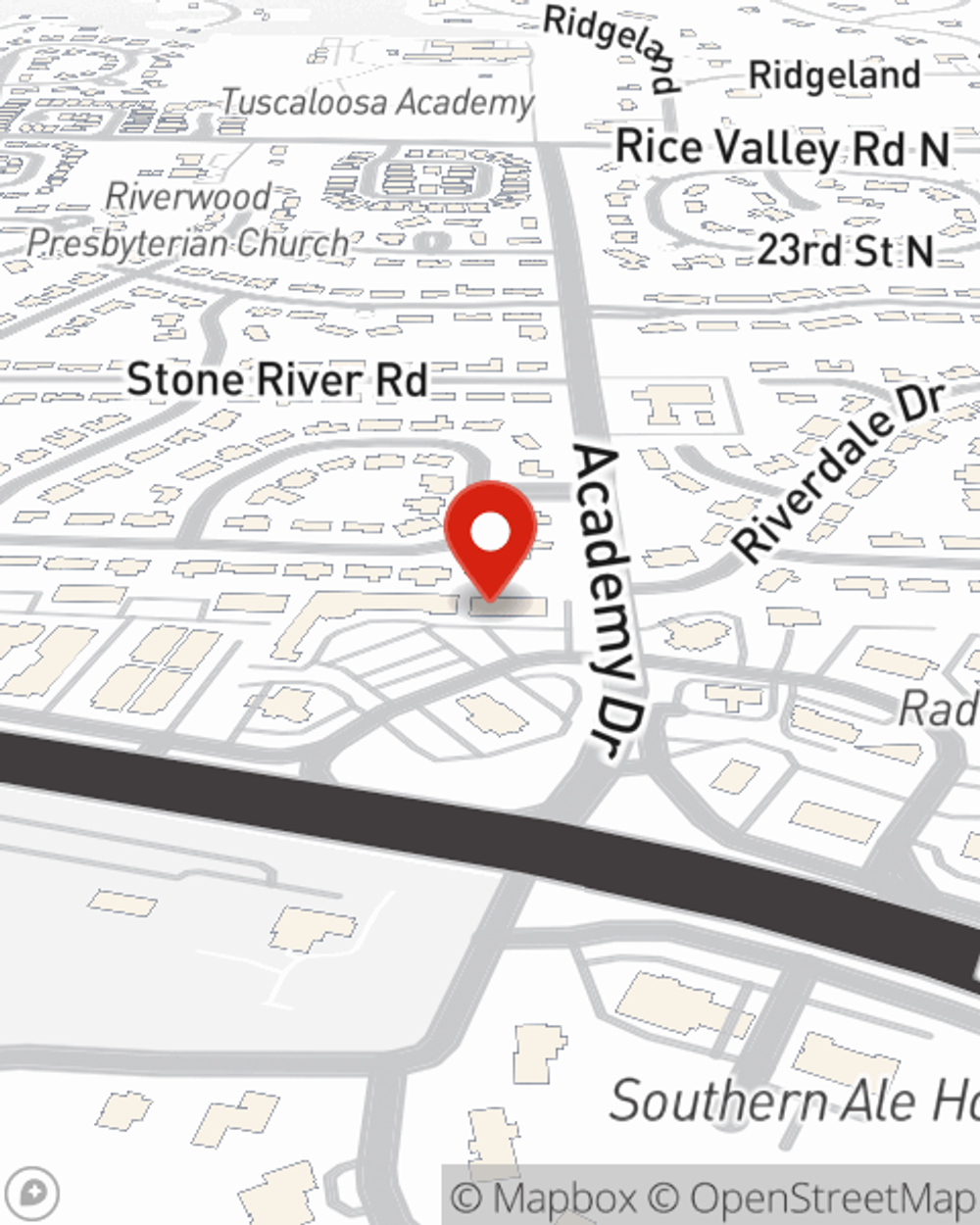

Condo Insurance in and around Tuscaloosa

Get your Tuscaloosa condo insured right here!

Insure your condo with State Farm today

- Tuscaloosa County

- Tuscaloosa

- Northport

- Alabama

- Mississippi

- Tennessee

- The Townes

- Highgrove

- Waterfall

- Crown Pointe

- Coker

- Brookwood

- Fosters

Your Search For Condo Insurance Ends With State Farm

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected mishap or trouble. And you also want to be sure you have liability coverage in case someone gets hurt on your property.

Get your Tuscaloosa condo insured right here!

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Michael McGuire is ready to help you prepare for potential mishaps with dependable coverage for all your condo insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Michael McGuire can help you submit your claim. Keep your condo sweet condo with State Farm!

If you want to get started, State Farm agent Michael McGuire is ready to help! Simply visit Michael McGuire today and say you are interested in this terrific coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Michael at (205) 752-8500 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Michael McGuire

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.